The Ultimate Guide To Pkf Advisory Services

Table of Contents7 Easy Facts About Pkf Advisory Services ExplainedThe 10-Second Trick For Pkf Advisory ServicesLittle Known Questions About Pkf Advisory Services.Pkf Advisory Services Things To Know Before You Get ThisThe Basic Principles Of Pkf Advisory Services

If you're looking for additional information beyond what you can discover on-line, it's simple to get begun with an in-depth, individualized financial plan that you can examine without expense or commitment. Appreciate the ongoing assistance of a dedicated consultant in your corner.The complete expense you are expected to pay, including the internet advisory fee and the underlying fund fees and costs, is about 1.00% of possessions under management. For added information on costs and expenses of the service, please read the Charges and Payment area of the. The T. Rowe Cost Retired Life Advisory Service is a nondiscretionary financial planning and retired life revenue preparation service and an optional managed account program supplied by T.

Brokerage firm accounts for the Retired life Advisory Solution are supplied by T. Rowe Price Financial Investment Services, Inc., member FINRA/SIPC, and are brought by Pershing LLC, a BNY Mellon business, member NYSE/FINRA/SIPC, which works as a clearing up broker for T. Rowe Rate Financial Investment Solutions, Inc. T. Rowe Rate Advisory Services, Inc. and T.

The Best Guide To Pkf Advisory Services

Giving recommendations is an essential part of IFC's approach to create markets and set in motion exclusive financial investment. With this work, we help establish the needed problems that will certainly attract one of the most private capital, making it possible for the economic sector to expand. IFC is changing to a more tactical strategy, systematically connecting our advising programs to the greatest needs recognized in World Financial institution Group nation and market strategies.

Financial suggestions can be valuable at turning factors in your life. Like when you're starting a family, being retrenched, intending for retirement or managing an inheritance.

The Only Guide for Pkf Advisory Services

Once you have actually agreed to go in advance, your economic adviser will certainly prepare a monetary strategy for you. You must always feel comfortable with your adviser and their advice. PKF Advisory Services.

Prior to you invest in an MDA, contrast the advantages to the expenses and dangers. To secure your cash: Don't give your consultant power of lawyer. Never ever authorize an empty paper. Put a time frame on any kind of authority you provide to purchase and sell financial investments in your place. Firmly insist all communication concerning your financial investments are sent to you, not simply your adviser.

If you're relocating to a brand-new adviser, you'll require to organize to move your economic documents to them. If you require assistance, ask your advisor to describe the procedure.

Unknown Facts About Pkf Advisory Services

Yet several assets come with obligations connected. So, it comes to be important to establish the genuine value of a possession. The knowledge of resolving or canceling the responsibilities features the understanding of your learn the facts here now funds. The total procedure assists construct properties that don't come to be a burden in the future. It used to be called conserving for a wet day.

Like your best auto guy, financial experts have years of training and experience behind them. They have a deep understanding of monetary items, market movement, and risk monitoring so you can rely on that the choices that make up your monetary strategy are made with self-confidence.

Some Known Factual Statements About Pkf Advisory Services

This is what you can make use of to attempt the sushi put the road or see your preferred band at Red Rocks. PKF Advisory Services. When it concerns tax obligations, a good economic consultant will guarantee that you're only paying the minimum amount you're required to pay, aiding you put some of your hard-earned cash back in your pocket

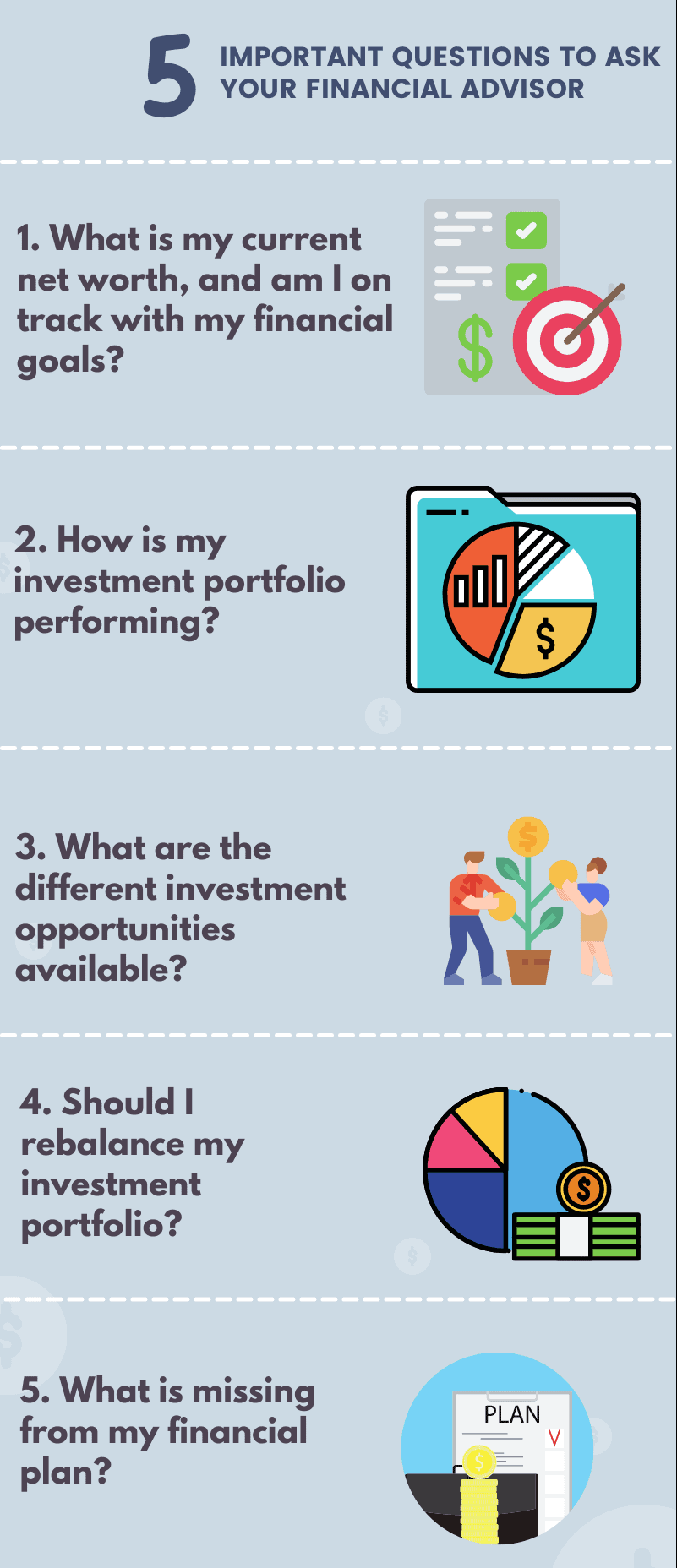

The potential value of economic suggestions depends upon your financial scenario. Whether you're just starting or well right into retirement, getting skilled advice or a consultation about your finances can be useful at every phase of life. Here are five usual factors to work with an economic consultant. You require assistance setting monetary objectives for your future You're uncertain exactly how to invest your money You're in the middle of (or planning for) a significant life event You need accountability or an unbiased second point of view You merely don't such as handling cash To establish if working with an economic expert is appropriate for you and make certain a successful relationship, the most effective point to do is ask great concerns in advance.

Here are a couple of examples of inquiries you can ask an economic consultant in the first conference. A monetary consultant that is a fiduciary is called for by law to act in your ideal click for more passion.